Digital Wallet: PicPay’s most mature offering, digital wallet, enables users to perform a wide range of financial transactions. Users can add funds to the balance of their accounts in different ways: electronic funds transfers from their accounts held with other financial institutions, including via the Brazilian Central Bank’s recently developed instant payment system, PIX, via boleto, by receiving funds via P2P payments or contracting loans. Users also earn interest on their wallet balances. Users can also onboard any credit card to make electronic transfers and payments. The company believes it pioneered the use of QR code in 2013 to enable instant payment transfers between people in Brazil. PicPay strives to provide a complete and open payment ecosystem that allows people and merchants to send, transfer, receive and manage their own money in simple and innovative ways, including P2P, P2B, and P2M transfers, and the company charges fees in connection with certain payment transactions and fund transfers carried out by its users through its platform.

Business & Acceptance (Seller): Currently, 1.5 million merchants already accept PicPay as a payment method in-store and online through QR Code, and since 2019, PicPay has been seeking to expand its acceptance and presence with retail companies and in several sectors, such as restaurants, gas stations, supermarkets, pharmacies, among others. In addition to allowing businesses of all sizes to accept digital payments, merchants integrated with PicPay can have access to advanced technologies and artificial intelligence to engage their target audience, and still have access to PicPay’s massive 55 million user base.

![]()

Financial Marketplace: PicPay offers a marketplace for third-party financial services with integrated experiences for individuals and businesses, including the PicPay Card, loans, and P2P lending. In May of 2021, the company launched its first insurance product, and it also expects to offer additional products such as investments later in the year. PicPay focuses only on the distribution of these services, without credit or underwriting risk. The company benefits from an Artificial Intelligence-driven model and intense use of machine learning to provide more accurate offerings with a personalized approach targeted at users’ needs. PicPay also generates user credit scores based on a proprietary algorithm. The company receives commissions from its partners in connection with the financial services that are purchased on its platform.

PicPay Store: the PicPay Store is an open platform that allows businesses to create customized mini apps to connect their products, services and experiences to millions of PicPay users. These products and services include: (1) digital goods, such as in-game credits, cellular phone recharge credits (top-ups) and transportation tickets; and (2) physical goods, such as food delivery. The company believes that the PicPay Store’s open platform will allow it to scale merchant partner integrations to faster serve a wide range of market segments. PicPay earns commissions from the sale of third-party goods through the PicPay Store.

Ads: PicPay plans to offer ads to allow merchants and brands to reach audiences based on user behavior and purchase history in order to drive actions such as shopping, watching and sharing content. The company plans to use Artificial Intelligence to create recommendation models to suggest products, offers and content on user interfaces. PicPay ads content is expected to include promoted recommendations and promoted branded content created by its partners, advertiser funded rewards, such as discounts, cashbacks and coupons integrated with user wallets, and monetized interactions, in which audiences are given financial incentives to watch, click or share promoted branded content. We intend to monetize this business by charging impression and conversion fees. PicPay currently expects to display ads on its application by the end of 2021.

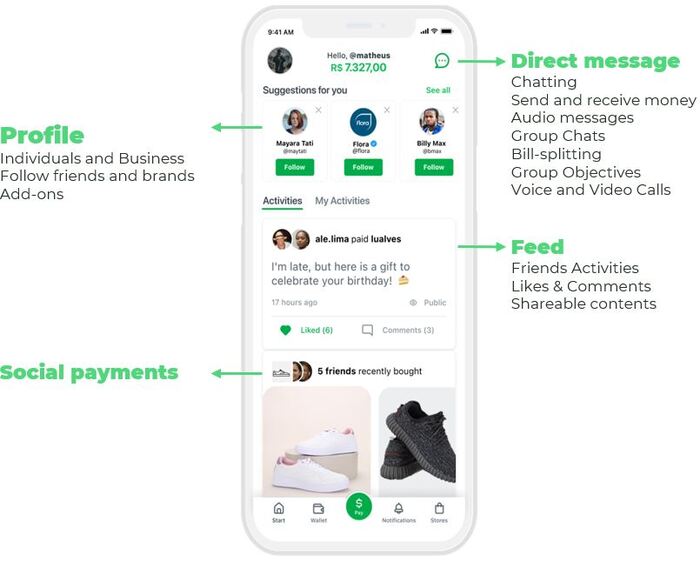

Social: Connecting people has been a part of PicPay’s DNA since its inception in 2012. In 2013, the company launched its P2P social payments platform. Since then, PicPay has added other social features to its platform, including profiles and social feeds. The company just finished launching its direct messaging service in April 2021, with group chats and voice and video calls to follow later in the year. Today, PicPay social platform is fully integrated with its financial services offerings. The company believes this integration creates a network effect and improves the performance of its revenue streams.